Don’t Underestimate the Value Of ‘Wait & See’

April 30, 2024

Adaptability is about the powerful difference between adapting to cope and adapting to win.

—Max McKeown

The S&P 500 looks like it will close down in April. The ride has been particularly volatile, with the S&P at one point down 5.5% as of April 19.

Spoiler alert: we are not reducing U.S. equity exposure heading into May. As intermediate- to long-term trend followers, we design strategies that generally keep us invested during times like this, which happen with more regularity than one might realize. We intend to (hopefully) ride out what we believe may be, over the long term, immaterial downside volatility.

While passive asset managers might make a similar argument about not getting anxious when routine declines happen, we differ from the passive crowd because we absolutely intend to act when there are material downtrends. We purposefully designed the timeframes utilized by our systematic investing process to ignore noise but react when there’s meaningful evidence of a trend change. We believe you need a time-tested, repeatable mechanism to alert you to the difference.

In this month’s Note, we put the S&P 500’s performance in greater context, specifically relating to monthly declines of 5% or more. Additionally, we discuss how one of the biggest benefits of trend following is its ability to influence investor behavior by applying a disciplined, repeatable process that can help investors stay rational during unsettling times. In our view, this is the key to long-term compounding and will help our clients achieve their financial goals.

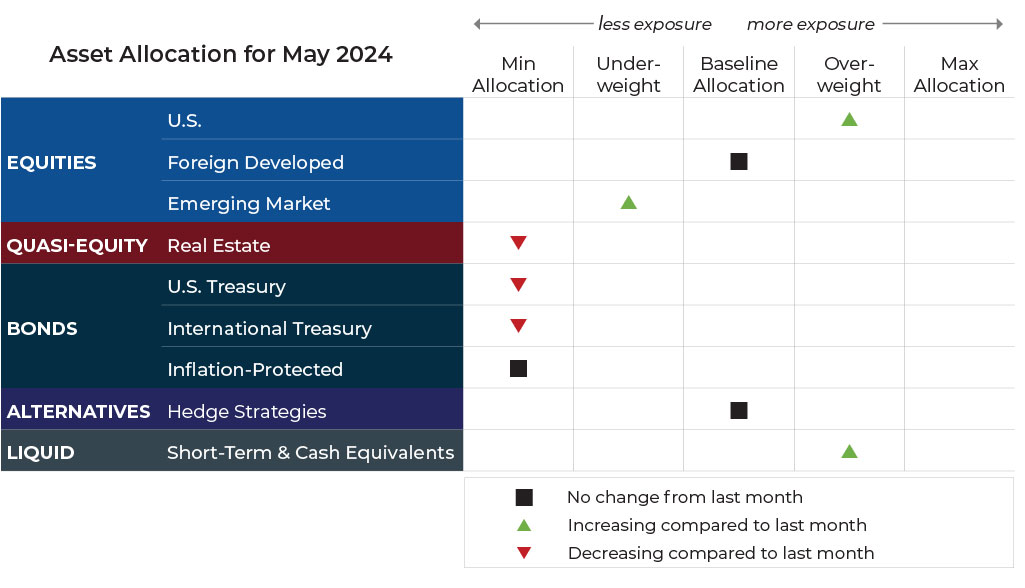

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for May.

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility

U.S. Equities

International Equities

Exposure will increase slightly and remain underweight overall. Trends are positive across all timeframes and while still weaker than its U.S. counterparts, emerging markets have strengthened enough to warrant a higher allocation as we enter May.

Real Estate

U.S. & International Treasuries

Exposure will decrease to its minimum allocation as the long-term trend joins the intermediate term in negative territory.

Inflation-Protected Bonds

Exposure will not change and remains at its minimum due to downtrends across both timeframes.

Alternatives

Exposure will not change and remains at baseline, which is also our maximum limit for this asset class. Uptrends persist across both timeframes for gold.

Short-Term Fixed Income

Exposure will increase as it takes on exposure from weaker fixed income instruments.

Asset-Level Overview

Equities & Real Estate

After a string of five consecutive positive months, the S&P 500 Index took a perhaps-overdue breather in April, falling as much as 5.5% during the month. The decline was broad, with every major segment decreasing. The largest declines have thus far been small caps and technology. In fact, small caps have now turned negative for the year, signifying how material the drop has been.

On the bright side, the trends that have driven positive returns for most U.S. equity assets remain intact. Therefore, based on the current price trends, Komara Capital Partners portfolios will remain overweight U.S. equities. Moreover, allocations will generally increase due to our continuum-based approach to risk management which involves stronger asset classes assuming the allocations of weaker, yet similar, assets. The handoff from real estate securities to U.S. equities is an example this month.

Speaking of real estate securities, recent economic headlines have placed in severe doubt the prospect of lower interest rates in 2024. This has helped propel the asset class into downtrends across both timeframes. The result is that allocations will be reduced to their minimum level in our portfolios.

International equities closed the gap in April but are still weaker than their U.S. counterparts. Due to the relative weakness, our portfolios will continue to be underweight. However, a small uptick in exposure will occur for emerging markets as it generally fell less in April and continued its uptrends.

Fixed Income & Alternatives

The same economic reports that have largely contributed to the recent down volatility in real estate have done so to fixed income assets as well. In April, fixed income followed U.S. equities into the red, pushing further into negative territory for 2024 year-to-date. The intermediate-term uptrends that were clinging to a positive position entering the month have joined their long-term counterparts in a downward direction. Therefore, allocations will go back to their minimum, with the exposure being moved to ultra-short-term Treasuries. Komara Capital Partners portfolios will remain overweight on the very short end of duration and completely out of longer-duration instruments.

After April’s continued rally, gold moves from one of the best-performing asset classes in our portfolios to the best thus far in 2024. Not surprisingly, trends continue to be positive as the month ends. As a result, exposure in our portfolios will not change and will remain at its maximum allocation.

3 Potential Catalysts For Trend Changes

Not Slowing Down: Robust inflation data during the first quarter has raised questions about whether or not the Federal Reserve will be able to lower interest rates this year. “The recent data have clearly not given us greater confidence and instead indicate that it is likely to take longer than expected to achieve that confidence,” said Jerome Powell. At the press conference following the December 2023 meeting of the Federal Open Markets Committee, Powell’s tone was markedly dovish. He took the markets by surprise when he acknowledged the Committee had discussed conditions for rate cuts and would not have to wait until inflation was at 2%. Economists are forecasting core inflation will end 2024 above 3%, which is up from 2.8% in March and moving even further above the Fed’s 2% target.

Going Backwards: Mortgage rates have rebounded past 7% and home sales in March slowed. In fact, they had their biggest monthly drop in more than a year, which renewed pressure on the U.S. housing market as confusion over real-estate commissions shakes the industry. According to a recent report from Freddie Mac, the average rate for the standard 30-year fixed mortgage has jumped by almost a quarter percentage point to 7.1%, yielding the highest mortgage rate level since late 2023 and the largest weekly increase in almost a year. The recent jump in borrowing costs could drag affordability back to the new lows it reached last year. Home prices are near record highs and other costs to own a home, such as insurance premiums, property taxes, and maintenance, have increased as well.

Job Switching: The Federal Trade Commission has banned employers from using non-compete contracts for most workers. These were typically used by companies to prevent workers from joining rival firms. The new ban is already facing legal challenges from business groups, and the court decisions could have widespread implications, as the practice has grown more prevalent in the U.S. economy and now affects one in five American workers.

Even in Years with Above-Average Performance, Equity Markets Usually Have Points of Decline

That’s the beauty of discipline. It trumps everything.

—David Goggins

Even in the best of years, equity markets experience negative monthly returns. In fact, if you go back to 2000, there is only one year when the S&P 500 Index rose in all 12 months: 2017. This means that even in years of above-average performance — such as 2023, 2021, 2020, 2019, 2013, 2009, and so on — equity markets usually fall. In fact, it is common to see 5% monthly declines or more.

Since the inception of the SPDR S&P 500 ETF Trust in 1993, it has experienced a monthly decline of 5% or more 36 times. That averages out to more than one per year. A quick glance at the list of those years with above-average performance years shows they are not exempt from this occurrence either.

Over the years, one of the central tenets of our A Systematic Walk Down Wall Street blog and these Monthly Notes has been to comment on studies that document average investor performance versus the S&P 500 Index. These studies show that investors tend to underperform versus a simple strategy of buying-and-holding a passive index — and by wide margins. There are many possible explanations. A big one, in our opinion, is investors’ inability to decipher between times to hold and times to run.

To counteract this tendency, we turn to the principles of trend following, which we think offer a more rational, systematic approach.

We believe one of the biggest benefits of trend following is its ability to influence investor behavior by applying a disciplined, repeatable process. Let’s explore what we mean.

Good behavior is generally understood as making the right decision among various choices, but as Charlie Munger would say, “Invert, always invert!” Inverting this thought would be saying that good behavior is making right decisions, but also avoiding wrong ones. We think a major benefit of being good at avoiding potentially stupid decisions is that it is arguably easier to achieve and more repeatable than the reverse, trying to be smarter than everyone else.

From our research, selling when a market is in a long-term uptrend but declines a few percentage points is usually a bad decision. Thus, in today’s market, following our rules and staying overweight in equities creates what we believe is good behavior that can benefit our clients. Doing so over and over means we can target performing well over many years, seeking to do so without having to play catch-up or endure the stress of falling way behind.

A sibling (or maybe close cousin…) to behavior is discipline. If behavior is making right decisions and avoiding dumb ones, then discipline is the ability to do that repeatedly in the face of stress, doubt, and outside pressure. We agree with the sentiment captured in the quote above from former Navy Seal and ultramarathoner David Goggins: discipline trumps everything. We think that if you’re following even a subpar investing process, discipline is what fosters compounding, which simply needs time to produce potentially great results. No brilliance necessary.

In our experience, investors often overthink the need to time entries and exits perfectly. They are constantly living in fear of a bear market and looking for reasons to trim exposure or exit when they should be adding to positions. Likewise (though less often), they may look for reasons to buy when they should be reducing or heading to safety. If there is anything we are confident of, it is that the timing matters far less than broadly sticking with uptrends, avoiding downtrends, and doing it consistently.

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead