Why We Don't Try to Read Political or Economic Tea Leaves

October 31, 2024

The art of simplicity is a puzzle of complexity.

—Douglas Horton

As the election season unfolds, markets can become a reflection of a broader, collective sentiment — sometimes swayed by predictions, fears, and assumptions about the future. In times like these, emotional investing is seemingly at an all-time high, with many investors feeling the pull to respond to headlines and perceived market shifts. But while the news cycle may push for reaction, our approach remains the same: disciplined, systematic trend following.

In investing, staying the course requires a willingness to let markets tell us where the real opportunities are, even when external forces attempt to predict or sway. At Komara Capital Partners, we aim to bypass the noise by anchoring our decisions to repeatable and reliable systems rather than attempting to read the political or economic tea leaves. It’s a steady-handed strategy, and while it may not grab headlines, we believe it’s the surest way to deliver long-term, repeatable results.

Does this mean we’ll always be well-positioned for whatever happens in upcoming elections? That’s unknowable until after the fact. However, we take confidence in the principle that price often predicts news. In other words, should a downside surprise in markets occur as a response to election results or any other event, systematic investing strategies that use a trend-following approach will provide predetermined exits aimed at limiting downside risk so clients can survive another day.

Alongside the election, the unprecedented rise in NVIDIA’s market cap has been the talk of the town. Therefore, in this Investment Update, we discuss:

- The potential risks of market concentration

- Why a disciplined trend-following approach has kept us positioned in NVIDIA through market shifts

- How staying committed to trends, even during periods of uncertainty, supports both growth and risk management

- Why a consistent systematic approach can provide investors with a reliable framework regardless of market or political cycles

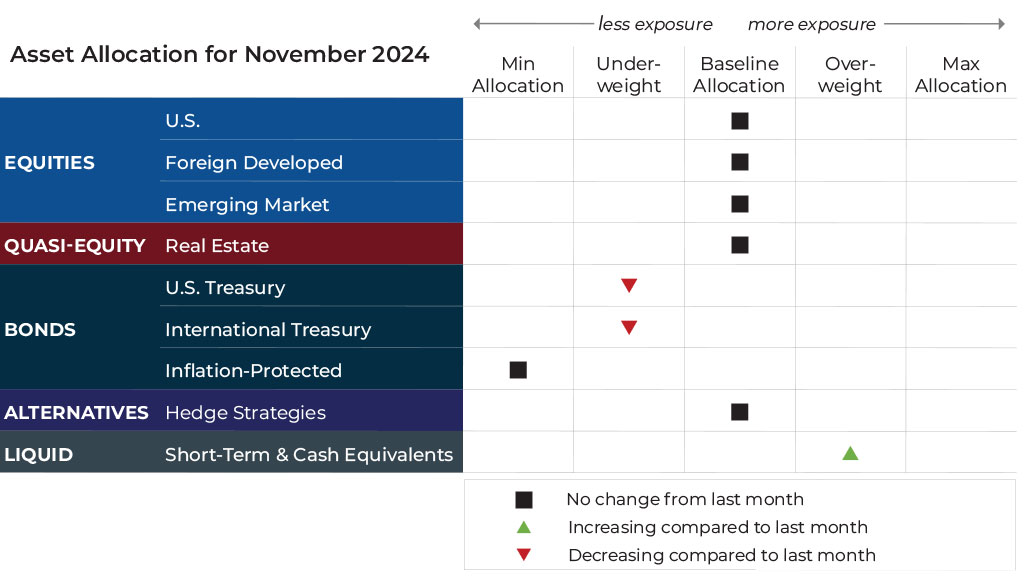

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for November.

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility

U.S. Equities

International Equities

Exposure will stay at the baseline allocation. Trends are positive across all timeframes.

Real Estate

U.S. & International Treasuries

Exposure will decrease and move to underweight. The intermediate-term trend is now negative among Treasuries of duration greater than three years, both domestically and internationally. The long-term trends remain positive.

Inflation-Protected Bonds

Exposure will remain at its minimum due to relative weakness compared to other fixed income segments.

Alternatives

Exposure is expressed through a multi-asset alternative ETF. The largest net allocation remains long bonds, but the portfolio has also picked up significant exposure to commodities. Equities remain a meaningful allocation.

Short-Term Fixed Income

Exposure will increase as it picks up allocation vacated by weaker fixed income instruments of higher duration.

Asset-Level Overview

Equities & Real Estate

Another month, another new all-time high in the S&P 500 Index. Despite one of the most contentious elections in recent memory racing toward its final days and continued escalation in the Middle East between Israel and its neighbors, the benchmark U.S. index remains on its march higher as we drift further into the fourth quarter. For the year, U.S. large cap growth stocks are still in front, but almost all segments are having a relatively good 2024. Volatility also remains low, which is almost always associated with continued strength in equities. As a result, there will be no changes to the U.S. equity allocation as we enter November.

Emerging markets have pulled ahead of their developed counterparts for the year but remain weaker than U.S. stocks. Like in the U.S., trends continue to be positive and consequently there will be no change to exposure in November.

Doubts about whether the Federal Reserve will be able to continue cutting rates as aggressively as it did in September put a damper on the recent rally among real estate securities during October. Despite that, trends continue to be positive. The result will be no change to the real estate allocations in our portfolios.

Fixed Income & Alternatives

After a run of four straight months of exposure increases to higher-duration bonds in our portfolios, October provided a sharp retracement to bond prices as yields rose. While not all the accumulated allocation will be vacated, a sizable portion of it will return to ultra-short-term bonds, which has often held much of the bond exposure since late 2021 when rates first began increasing. These types of whipsaws in markets are a reality of trend following. That said, over the long-term they tend to not materially impact performance and can provide valuable opportunities to harvest losses against other better-performing assets, such as U.S. equities in 2024.

For the alternatives allocation in our portfolios, long fixed income remains the most influential exposure. Net long equity exposure remains a notable segment.

3 Potential Catalysts For Trend Changes

Goldilocks Economy: Gross domestic product increased at a 2.8% annual rate in Q3, adjusted for seasonality and inflation. Consumer spending represents a large amount of economic activity in the U.S. and picked up to a 3.7% growth pace during the same time period. Other tailwinds were strong exports and government spending on defense. Inflation showed cooling: the personal consumption expenditures (PCE) price index eased to a 1.5% annualized rate versus 2.5% in Q2 while the core PCE index cooled to 2.2% from 2.8% (hovering near the Federal Reserve’s target of 2% annual inflation). However, the two big, recent hurricanes are likely to show up in data for Q4 and beyond.

Mortgage Rates Drop, Then Bounce Back: Expectations that the Federal Reserve would cut rates caused mortgage rates to drop to 6.08%, which is a two-year low. But the move may have come too late in the year to lure buyers, as many families prefer to buy in the spring and move houses between school years. And the reprieve did not last long, with rates recently rising for three straight weeks to the highest level since August to 6.54%. As a result, mortgage applications have fallen for four straight weeks.

Home Sales: For the second consecutive year, existing-home sales are on track for the worst year since 1995. New-home sales rose 6% in September versus one year ago, driven largely by the fact that there has been little else available to buy. About 60% of outstanding U.S. mortgage holders have a rate below 4%, there is pent-up demand to sell homes, and the aggregate value of home equity as a share of total real-estate value has hit 73% – the highest level since the 1950s. This may make homeowners willing to take on more expensive mortgages sooner than expected.

The Rise & Risk Of NVIDIA

The best thing one can do when it’s raining is to let it rain.

—Henry Wadsworth Longfellow

Torsten Sløk, an economist at Apollo Group Management, recently highlighted what we think are some mind-blowing facts about NVIDIA. He noted:

- NVIDIA’s market capitalization is now bigger than FIVE of the G7 countries.

- Only the U.S. and Japan have a higher overall market cap greater than the AI darling.

- This means NVIDIA surpasses the value of entire equity markets for Canada, the U.K., France, Germany, and Italy. In fact, you could combine Germany and Italy and you’d still be smaller than NVIDIA.

About one year ago, NVIDIA was flirting with a ceiling around $500 per share (i.e., equivalent to $50 per share in today’s post-10:1 split world). It has now hit new all-time highs that are almost 3x that level (i.e., $140 per share or $1,400 on a pre-split basis)! The impressive increase in value has no doubt boosted many investors’ returns but also now represents a meaningful risk.

The rise and risk of NVIDIA can be used to illustrate what we believe are two of the most unheralded benefits of systematic trend following for investors:

1) Staying the course (in a repeatable way) when your brain is screaming, “run!” At $500 per share ($50/share post-split) our portfolios were overweight to NVIDIA and can vividly recall multiple clients expressing concern about the risk of a steep decline in the stock, which could negatively impact a portfolio. Very few (if any) were confident in the prospects of remaining overweight at that level. We will not take any personal credit for staying the course, as the decision had everything to do with our repeatable trend-following rules and nothing to do with our powers of prediction. Fast forward a year, and that systematic overweight stance has arguably provided the largest attribution to positive performance during the last year and beyond.

2) Providing a kill switch to exit a trend. Not only does trend following provide what we believe is the most reliable way to capture outliers, but in our opinion, it also allows investors to have a RELIABLE exit strategy for when the tide eventually turns. One of the tools we use for this purpose is the 100-day exponential moving average (EMA). At the end of 2023, NVIDIA closed the year a little above $49 per share and its 100-day EMA was around 45 — that was about $4 away from the sell-point if someone were to use the 100-day EMA as their sole rule for when to sell. While our exact exit would not have necessarily been that price, we certainly would have been standing by, ready to reduce exposure if all the data we monitor called for it. And here’s the more important part, in our view: As a stock’s price increases, so does its 100-day EMA. Therefore, NVIDIA’s EMA has now increased to around 110 per share. This means that our approximate reduction point has automatically increased in a way that RELIABLY adjusts for volatility, gives the stock room to continue running, and doesn’t require giving up a large portion of the gains from the last year.

The key concept from the last two paragraphs is RELIABILITY. It is one thing to capture returns. It is quite another to do it in a way that the same set of facts can produce a consistent outcome over and over. That is our goal at Komara Capital Partners.

It is not enough to provide solid returns. For clients to be able to lean on us and rely on us, we have to produce returns in a way they can expect now, next year, 10 years from now, and beyond.

We believe a day of reckoning is coming for NVIDIA, and investors with overly-concentrated portfolios and no plan will likely pay the price. However, no one knows when that day will occur. In our opinion, it is better not to guess, but rather to have a process that is agnostic and indifferent. We have no emotional connection to NVIDIA but are happy to benefit from its rise for as long as the trend permits. We continue to be thrilled to extend this measured, resilient approach to our clients, empowering them to navigate markets with clarity and conviction.

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead