Steady. But Ready.

September 30, 2025

We suffer more often in imagination than in reality.

—Seneca

September has historically been a market weak spot, yet it has defied expectations. Instead of stumbling, stocks are pushing to new highs, volatility remains muted, and the seasonal trapdoor that investors often brace for has yet to appear.

That ongoing divergence from history highlights why we rely on process over prediction. Markets will often tempt investors with patterns, narratives, and gut instincts, but those don’t provide a consistent edge. A systematic investing approach does, in our view. It adapts to what’s actually happening — capturing strength while it lasts and cutting risk when conditions change — and it removes the guesswork that so often derails long-term plans.

In this month’s Note, we look at how markets navigated September’s supposed weakness, the potential catalysts that could bend trends from here, and why consistency is as important in strong markets as it is during downturns.

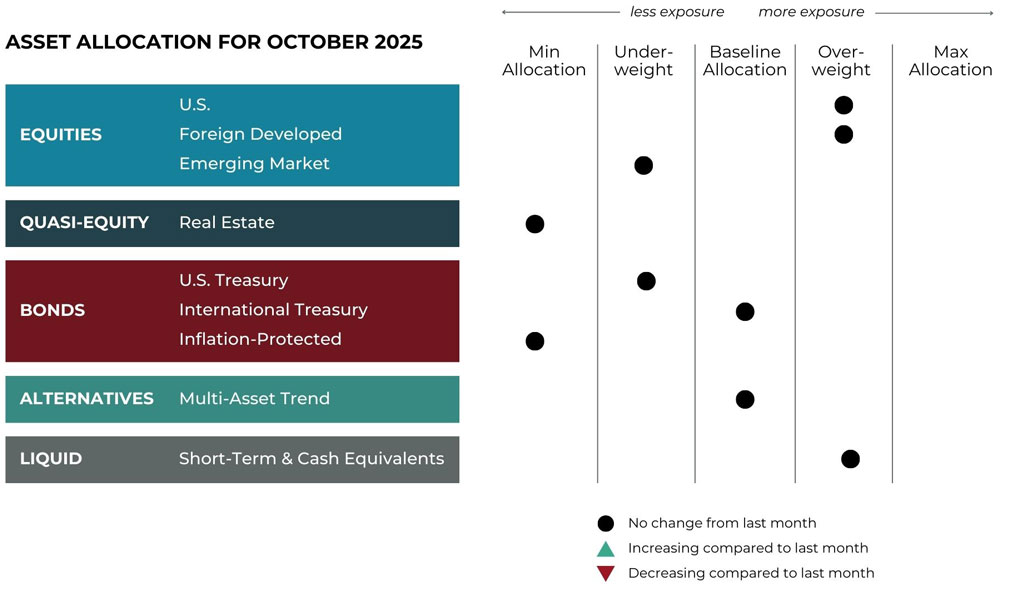

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for October.

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility

U.S. Equities

International Equities

Overall exposure will not change and remain at baseline. Trends continue to be positive across all timeframes and tilted toward foreign developed equities given its relative strength.

Real Estate

U.S. & International Treasuries

U.S. exposure will not change and remain underweight. Trends in the middle part of the U.S. Treasury yield curve are positive while the long-term end is negative. International Treasuries have weakened but are maintaining uptrends, and their overall allocation will remain at its baseline allocation.

Inflation-Protected Bonds

Exposure will be at its minimum. Trends are still positive but the group remains weak versus other fixed income assets.

Alternatives

Exposure is expressed through a multi-asset alternative ETF. Bonds (net long) continue to hold the most influential allocation, now followed by stocks (net long). Commodities remain slightly net long as well. The currency portfolio remains net short the U.S. Dollar.

Short-Term Fixed Income

Exposure will not change, having previously absorbed exposure from weaker, higher-duration bonds.

Asset-Level Overview

Equities & Real Estate

Despite September being the market’s weakest month on average — and the only one with a negative long-term return — the S&P 500 has so far delivered solid gains and reached new all-time highs. Price volatility continued to be low, which we have found to be highly correlated with favorable environments for positive performance in stocks. While things can change quickly, trends remain very positive and as a result our strategies will remain fully invested.

International stocks also enjoyed positive performance in September, approximately in line with the U.S. Emerging markets are running ahead of foreign developed, and both segments continue to experience uptrends. There will be no change to our fully invested status.

In a landscape of surging equities, real estate remains the weakest and within a sideways range. While the Fed’s benchmark rate just experienced its first decrease of 2025, mortgage rates remain mostly unchanged. With inflation and tariffs still providing some uncertainty, strongly positive trends have yet to materialize. The outcome of such trendless conditions will be a continued allocation at the minimum in this asset class, as our portfolios previously handed real estate exposure up to much-stronger U.S. equities.

Fixed Income & Alternatives

Bond instruments with intermediate to long duration generally moved higher over the last 30 days but remain relatively weak as the path of interest rates continues to be foggy. Perhaps more importantly, the risk/return tradeoff for these instruments is currently inferior to their short-term counterparts. The result is that exposure in our portfolios will not change, with intermediate bonds being underweight and long duration exposure being near zero.

Within the multi-asset trend alternatives bucket, short-term fixed income futures and other related instruments remain the most significant in terms of allocation. Exposure to longer-duration bonds remains primarily in short positions. Commodities, such as gold and cocoa, also make up noteworthy positions. Meanwhile, the continued strength in stocks globally has caused net long exposure to increase as well. The U.S. Dollar’s steady decline has caused this segment to increase allocations to foreign-denominated currencies.

3 Potential Catalysts For Trend Changes

Slowing Business Growth: A monthly indicator of activity in the manufacturing and services sectors decreased to 53.6 in September, down from 54.6 in August. This reading of the S&P Global Flash U.S. Composite PMI indicates overall business activity continued to expand, but the pace was the slowest in three months. “Although tariffs were again cited as a driver of higher input costs across both manufacturing and services, the number of companies able to hike selling prices to pass these costs on to customers has fallen, hinting at squeezed margins but boding well for inflation to moderate,” said Chris Williamson, an Economist at S&P Global.

Housing Freeze: Home sales remain at historically low levels, and home prices have soared 52% since August 2019. However, home prices are declining compared to a year ago in many southern markets, particularly Florida and Texas. As for mortgage rates, they declined earlier in September to 11-month lows in advance of the Federal Reserve’s decision to cut short-term interest rates. Applications for mortgages rose a bit, as some rushed to take advantage of the decline. Although the Fed seems to be in cutting mode, mortgage rates may not fall fast. This is because the Fed sets a target for short-term, overnight interest rate – but mortgages are generally more associated with the longer-term yield on 10-year U.S. Treasuries (approximately the expected duration a homeowner might hold a 30-year mortgage before moving or refinancing).

Last Year’s Report Card: Inflation ate into Americans’ wage gains in 2024, according to new Census Bureau data. This left most household incomes little changed, except for the richest ones. The data also show that average households have not gained economic ground since the COVID-19 pandemic, which underscores the continued toll of rising prices. Inflation-adjusted median household income last year was around $83,000, which is roughly the same level as in 2019, pre-pandemic 2020, after the sharp declines that followed COVID’s onset, and the tepid recovery since then. The only statistically significant change for 2024 was in incomes of high-earner households, which rose 4.2% in 2024. The report sheds new light on the state of the U.S. economy during the final year of the President Joe Biden administration. The economy has slowed considerably since then, and recent labor-market data shows several months of weak jobs growth.

What the Data Suggests For Q4

In preparing for battle I have always found that plans are useless, but planning is indispensable.

—Dwight D. Eisenhower

Now that we have surpassed the seasonally poor performance of September, it is reasonable to start thinking about Q4 and where things go from here.

This year has been a mixed bag for sure:

- High volatility in February

- Between mid-February and early-April, the S&P 500 reached roughly a 20%+ decline (the mainstream definition of a bear market)

- Low volatility driving markets to new all-time highs and double-digit returns through Q3

What the Data Suggests

According to an LPL Financial study, since 1950 when the S&P 500 has been up around 10% through September, Q4 has finished positive around 87% of the time, with an average gain of about 5%.

This level of performance surpasses the typical tendency of U.S. markets to increase.

With these findings in hand, we think investors should feel confident in the prevailing trends. Often, the right bet for clients who are suitable for growth is to remain invested, in our opinion. Deviating from this approach in favor of a discretionary flight to safety would be a poor decision regardless of whether the outcome turned out to be correct…which brings us back to the benefits of a systematic investing approach.

Steady But Ready

We’ve always believed in the benefits of following systematic trends, and we don’t shy away from sharing why it can help you reach your goals. Our friends like to joke that we never miss an opportunity to do so, and they’re not wrong! It can be difficult to find mainstream commentary about any approach outside of passive investing. You might be able to find some interesting information about the benefits of a value approach, or perhaps the usefulness of incorporating alternatives or other fringe assets.

Amidst this lack of information, we feel it’s our responsibility to explain how systematic trend following can help you as an investor. It is our goal to provide resources that help you make informed decisions. Even in a year like 2025, when our strategies slightly trail their passive counterparts so far, we think a systematic investing approach has still added value for investors. For example, when markets were rapidly declining in March and April, our strategies had already reduced exposure. Had markets continued to decline, investors would have been protected. Just because the result ended up not being devastating doesn’t mean the decision to move defensive was poor, especially since our investing process allows us to quickly regain exposure when conditions reverse — which is what we did.

An analogy would be preparing for and reacting to an earthquake. Any one can be “the big one,” but just because the last one wasn’t doesn’t make it a bad decision to get under your desk.

Now, as 2025 heads into Q4, our strategies sit with a slightly lower absolute return, but lower volatility, lower drawdowns, and better risk-adjusted return. This is the crux of the value proposition we offer to investors.

In closing, while 2025 currently looks great and the data suggests odds are good it will continue, 2026 is just around the corner. And the picture is constantly evolving.

We often talk about how effective markets are at discounting future scenarios. Just as one thing is quickly priced in, the next item is being parsed by investors. For example, it is possible ALL potential upcoming rate cuts have been priced in and markets are on the verge of pricing in whatever comes next. In our view, our strategies have proven they are ready. If you are not partnering with us, have yours?

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead