The Impact of Short Term, Incremental Improvements On Long-Term Success

January 31, 2024

You can't connect the dots looking forward; you can only connect them looking backwards.

—Steve Jobs

During numerous discussions with clients during recent months, the notion of “all-time highs” has surfaced. Often, these highs are perceived as a harbinger of downturns. However, we believe the evidence points to a contrary conclusion.

In January we saw the S&P 500 achieve four all-time highs, surpassing the previous peak from January 2022. In the context of market history, a span of a few years may seem minor, but enduring 512 days beneath the previous all-time high can be challenging for investors — not only psychologically, but also in terms of their long-term compounding potential.

Since 2013, a period widely recognized as a great period for stocks in the U.S., the S&P 500 notched 351 ATHs. This tally spans a broad range, from the 70 highs in 2021, to just one in 2022, and none in 2023. This is in stark contrast to the period from 1930 to 1953, which saw no new highs at all. To put it differently, the ATH from 1929 stood unchallenged until 1954! Could it be that the absence of ATHs is the actual omen of tougher times ahead?

Our analysis, which is viewed through the lens of trend following, suggests that trends, whether ascending or descending, tend to perpetuate themselves. That said, sometimes “but this time is different” actually proves to be true, and during these times we rely on trend data and pre-determined exit strategies to remove exposure, which can allow us to live and fight another day.

In this month’s Investment Update, we discuss how small improvements over time can lead to big results in the long term.

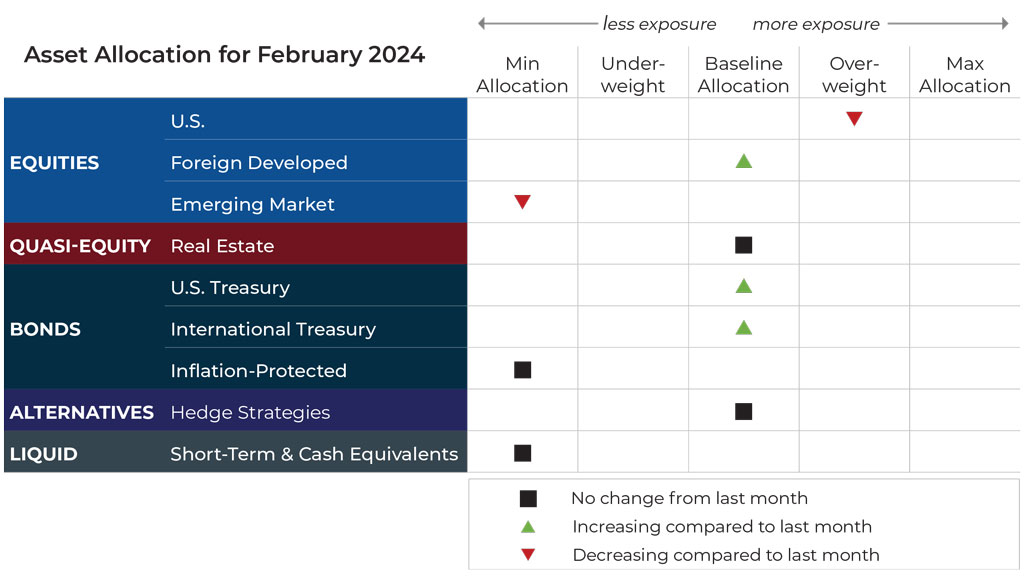

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for February.

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility

U.S. Equities

International Equities

Overall exposure will not change and remain underweight. Foreign developed will increase, taking exposure from weaker emerging market equities, which have resumed downtrends across both timeframes.

Real Estate

U.S. & International Treasuries

Exposure will increase and be at baseline allocations as uptrends persist across both timeframes.

Inflation-Protected Bonds

Exposure will not change due to the relative weakness of the asset class versus nominal Treasuries.

Alternatives

Exposure will not change. The baseline allocation for gold is also our highest limit, so we are already at the maximum allocation as trends in gold remain positive across both timeframes.

Short-Term Fixed Income

Exposure will not change and will remain with longer-duration fixed income instruments.

Asset-Level Overview

Equities & Real Estate

For the S&P 500 Index, 2024 began the way 2023 ended, with the largest technology and growth companies rallying. The moves were enough to push the benchmark large-cap index to a new all-time high for the first time since the opening trading day of 2022. As was also customary during 2023, other segments of the market lagged: value, dividend, mid, and small caps. The latter two have struggled to even hit positive territory as the month comes to a close. For February, Komara Capital Partners portfolios will generally see a small decrease to U.S. equities, though exposure will remain overweight.

Looking abroad, foreign equities have lagged their U.S. large cap counterparts. In developed economies, monthly losses appear to be imminent even though trends continue to be positive. In emerging economies, things are bleak, with economic weakness in China continuing to drag EM equity assets lower. In fact, allocations to emerging market equities in Komara Capital Partners portfolios will return to their minimum due to downtrends over all meaningful timeframes.

Real estate securities paused their rally, coinciding with talk of peak interest rates, while declining for the first time since October. Despite some losses in January, the overall picture for the asset class has not changed, as the upward trend continued. However, another month of declines could be enough to move allocations from baseline to underweight.

Fixed Income & Alternatives

Like real estate, fixed income generally experienced retracements in January, as market sentiment about the timing of rate decreases shifted out a bit further. From a price perspective, the strongest areas of the yield curve continued to be on short-end, with longer-duration bonds being the weakest. International Treasuries and inflation-protected performed virtually in lockstep. Allocations in our portfolios will increase slightly, but trends could easily shift in the coming months, particularly for longer-duration bonds.

Like most assets outside of U.S. large-cap equities, gold prices were down in January. Trends continue to be positive as January ends. As a result, exposure in our portfolios will not change and will remain at its baseline allocation.

3 Potential Catalysts For Trend Changes

Strong GDP: The recession forecasted by many economists never showed up in 2023. American consumers made sure of it. During the past year, the U.S. economy grew 3.1%, which encompasses a seasonally- and inflation-adjusted 3.3% pace during Q4. A resilient labor market supported strong consumer spending and helped avert a downturn.

Labor Supply/Demand: Many workers came off the sidelines to join the labor force in 2022 and 2023, which eased labor shortages and put downward pressure on wage growth. However, additional gains may be difficult to achieve. This is important because inflation remains above the Fed’s 2% target, even though we saw a major retreat last year. The participation rate, which is the share of Americans who are in the labor force, has essentially held steady since August. If labor supply does not increase, the fight against inflation might require an easing of demand or weaker growth.

Credit Issues: Consumers are putting more purchases on credit cards and taking longer to pay them off. The four biggest banks in the U.S. reported higher credit card spending in 2023 versus the previous year. Unpaid balances surpassed 2019 levels for the first time, an indication consumers are putting more on their credit cards and taking longer to pay off their bills than they did before the pandemic. Additionally, delinquency rates have continued to slowly rise since 2021.

Consistency Compounds

Plans are nothing; planning is everything.

—Dwight D. Eisenhower

January is commonly a time of resolutions and goal setting for society at large, as well as Komara Capital Partners. For us it’s less about resolving to do something better out of frustration about failed expectations. Instead, it is part of a thoughtful, systematic process for running our business and delivering value to our clients.

The methodical approach our firm takes toward achieving goals aligns with one of the sayings we use frequently: “It’s better to be consistently good than occasionally great.”

This saying can take on a variety of applications, but one meaning we favor is that it is better to repeatedly execute in hopes of small benefits that stack over time rather than looking for a shortcut to success. In other words, we would rather design simple processes than can be persistently implemented in all environments by all team members instead of complicated ones with high reward but high variability of outcomes (i.e., elegant > complex).

So how does this relate to the markets and client portfolios? In our mind, it’s that we’re now seeing the long-term fruits of our methodical approach to making allocation decisions.

Meb Faber, a fellow tend follower, recently noted an interesting idiosyncrasy between U.S. and international equities. To paraphrase, since 1950 most of the outperformance of U.S. equities over their global counterparts has occurred since 2009.

Komara Capital Partners portfolios have generally been tilted in favor of U.S. equities relative to international. The performance benefits created by these deployments of capital are minor when evaluated over 30 days and are even harder to spot when one mistakenly compares the portfolio’s performance to an incorrect benchmark, such as the S&P 500 or Dow Jones Index. However, consistently overweighting U.S. equities over the long term has, we believe, allowed us to steadily reap these harvests of outperformance, which can compound in a big way over time for those who are willing to be a little different than the mainstream.

Coupling those rewards with the fact that they are produced in a way that is dispassionate and unemotional should be comforting for our clients, who are trying to reach their goals without any knowledge of what the next 30-40 years will look like (or even the next 12 months).

In our experience, shooting for “consistently good” rather than “occasionally great” has served Komara Capital Partners well over the years.

In 2024, the only resolution we have is to continue consistently executing the systems that have gotten us to this point, while looking for ways to expand systematic thinking into new areas that serve our clients.

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead