Checking In On the Predictions about 2023

June 30, 2023

Those who have knowledge, don't predict. Those who predict, don't have knowledge.

—Lao Tzu

Our team takes pleasure in challenging commonly accepted investing beliefs.

One belief that we find particularly unhelpful for investors is the obsession with prediction. It’s quite amusing when we come across glaring examples we can’t resist mentioning.

Currently, the S&P 500 is within striking distance of its all-time high and has had a strong performance in the first half of the year. Interestingly, so-called experts in predicting the market have not had such a great start to the year. The average forecast from these predictors actually suggested a decrease in the S&P 500 this year. This was the first time since at least 1999 that the aggregate prediction has been negative. And yet, the S&P 500 is on track to have its fifth-best start to the year since 1990.

It’s important to note that six months remain in 2023. To avoid being hypocritical, we are not predicting that these predictions will prove false; they could turn out to be correct. Our intention is to highlight how blindly following the advice of so-called experts could negatively impact the compounding effect in an account.

In our latest Investment Update, we delve into more 2023 predictions and assess how they have performed year to date. We also explore how stock prices often anticipate news, as well as price’s connection to the rise of certain stocks that have been driving the overall indexes this year.

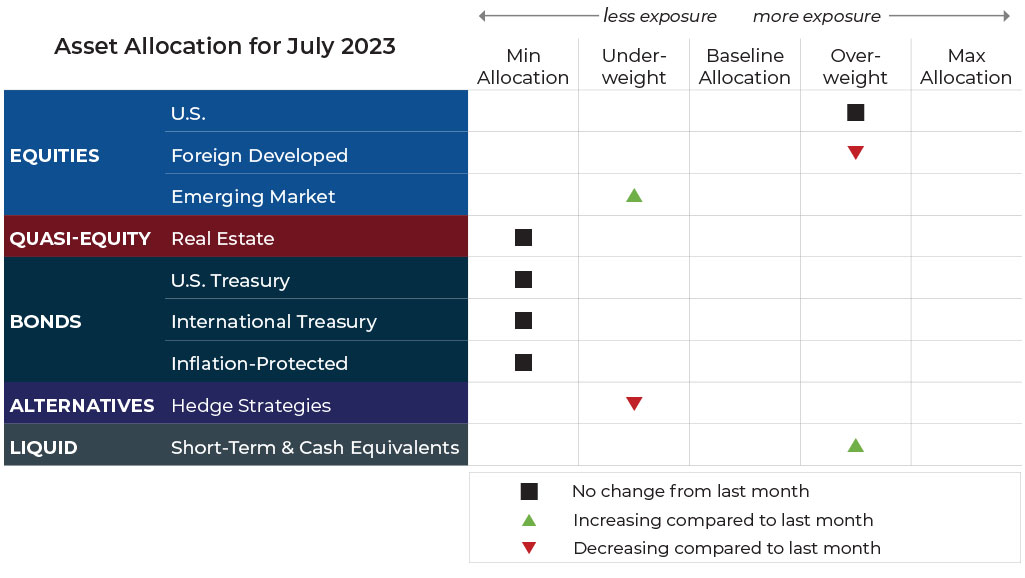

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for July.

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility

U.S. Equities

International Equities

Overall exposure will not change. Foreign developed equities continue to experience uptrends across both timeframes, but will give a portion of its overweight exposure back to emerging markets, which are now experiencing an intermediate-term uptrend.

Real Estate

U.S. & International Treasuries

Exposure will not change and remains underweight. Both U.S. and international bonds have downtrends across both timeframes.

Inflation-Protected Bonds

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Alternatives

Exposure will decrease due to the emergence of an intermediate-term downtrend. The vacated exposure will be handed-off to short-term fixed income.

Short-Term Fixed Income

Exposure will increase due to receiving exposure from gold. Short-term fixed income also continues to hold allocations previously received from weaker U.S., international, and inflation-protected bonds.

Asset-Level Overview

Equities & Real Estate

A theme of recent Asset-Level Overviews has been the tight ranges of equities with higher lows. It’s a similar story again this month. Equity markets produced broad gains in June, and leading U.S. and foreign developed markets experienced solid breakouts to strengthen previous uptrends. Make no mistake, technology and growth continue to lead, but almost all segments joined in the party. Value and dividend stocks, which have lagged significantly in 2023, produced intermediate-term uptrends. Likewise, small- and mid-cap stocks created uptrends across the shorter-term timeframe.

Foreign developed equities made a new one-year high and remained firmly trenched in uptrend territory. Importantly, emerging markets regained some strength and are able to take on exposure that had been vacated for much of 2023. It is impossible to know what happens next, but for market bulls the hope is that additional return will be created by previously weaker assets catching up to their stronger counterparts on the equity side.

Real estate securities continue to experience downtrends across both timeframes. As a result, all our portfolios will remain at their minimum allocation.

Fixed Income & Alternatives

Fixed income of almost any duration remained weak across the board. U.S., inflation-protected, international were all in downtrends. As a result, our portfolios will remain at their minimum allocations. Adding insult to injury is that yields remain lower than their very short-term counterparts.

Fortunately, yields continue to be favorable compared to recent history for Treasuries with less than a year duration. As of the time of this note, a six-month Treasury is providing an approximate 5.5% yield. Consequently, the primary source of bond exposure in our portfolios will continue to come from this segment.

Gold retraced further in June and is now experiencing a downtrend over the intermediate-term timeframe. As a result, gold will now be underweight in our portfolios.

3 Potential Catalysts For Trend Changes

Student Loans: The Supreme Court blocked the Biden administration’s plan to eliminate federal student debt for millions of borrowers. The forgiveness plan would have clear an estimated $430 billion in loans from the government’s books. About 24.3 million borrowers, or 53% of the total, owe less than $20,000 and stand to have their debts erased.

Summer Relief: It’s good news for wallets, as natural gas is starting the summer at less than half the price it was a year ago. Currently, natural gas hovers around $2.70 versus the $5-$7 range it was in last year, which should mean lower electricity bills for many American households when they crank up their air conditioners. Industrial companies, including makers of chemicals, cat litter, fertilizer, paper, wallboard, and steel have told investors in the past few weeks that lower gas bills are easing cost pressures.

Home Prices Lower, But Mortgages Still Expensive: Home prices posted their first year-over-year price decline in 11 years. However, higher mortgage rates made home purchasing more expensive for buyers. Mortgage rates rose rapidly in 2022, which caused a slowdown in home sales as buyers backed away from the market. Higher mortgage rates also made homeowners reluctant to sell, reducing the housing supply.

Imagine if Meteorologists Were Accurate 8% of the Time

1. We'll still be in a bear market by year's end

2. The U.S. will fall into a recession in 2023

3. The interest rate yield curve will reverse its inversion during the second-half of the year

4. The U.S. inflation rate ends the year far below expectations

5. Healthcare will be the top-performing sector in 2023

6. Gold-mining stocks will be among the best-performing industries

7. Energy stocks will struggle following a strong year

8. Apple will fall below $100

9. Toyota will close out 2023 as the world's largest automaker by market cap

10. China stocks will vastly outperform U.S. stocks

11. U.S. home prices fall as much as 20%

12. A financial crisis will unfold

—Sean Williams, The Motley Fool, 1/8/2023

The good news about making 12 predictions about the markets is that one of them is bound to be correct, right? In this case, energy stocks have indeed struggled (#7) year to date, so with half of the year left, that’s a pace of 8% accuracy. (As an aside, imagine if meteorologists were only 8% accurate.)

At the end of March, we had a bit of fun making a case for both a bull or bear run in equity markets. In the bull case, we wrote the following:

The fact that material bank issues have done little to alter this pattern of higher lows is arguably the strongest bull case of all. Investors are largely seeing this for what it is – a few banks paying the price for reckless decisions. Sadly, these types of situations have always existed and will likely continue.

There’s a solid argument to make about markets having already priced in all the bear scenarios. With the worst seeming to be behind us in regard to inflation, rate hikes, and banking issues, the markets may be slowly weeding out the remaining bears. In the absence of selling, the markets naturally tend to climb. If we’re about to climb, you want to be on board or get on board.

In last month’s update, we highlighted the fact that only a handful of stocks were driving the major equity indexes higher. In our view, a bifurcation like this isn’t that uncommon. We find that, in time, the leaders tend to fall back to earth or the others start to catch up. Based on June’s performance thus far, it appears the latter is the case.

Price Predicts News

One of the tenets of trend following is that focusing on price tends to put you in a relatively good position at almost all times. We think price reflects all or almost all relevant information, which means it may provide valuable information for those who can exploit it with robust systematic investing rules. The process need not be complicated, in our view. In fact, one could argue that simplicity leads to robustness across many different market environments.

We think the simplicity also means that price predicts the news. What we mean is that trend followers tend to make allocation changes based on a rules-based process, not necessarily because we know the underlying “why.” It is after the market confirms a trend, either up or down, that you start to see the headlines.

A great example of this is the current uptrend in U.S. stocks. Trend-following strategies are capable of embracing the uptrend in an unbiased way. For us, following our repeatable systematic process has pushed our portfolios toward some of the best-performing stocks in the S&P 500 year to date. This happened without knowing (or even acknowledging) the explanation. In some cases, it is only now that the news, or the “why,” is catching up and becoming clearer. In others, the “why” has yet to be determined.

As is represented in our opening quote to this section, predictions about recession in 2023 have been repeatedly foisted on investors. At one point, the market had priced in multiple interest rate cuts in 2023. With a strong economy continuing, the recession predictions are now being postponed to 2024, and there is little sign of rate cuts.

You would have likely been forgiven for trusting the experts and playing it safe coming into 2023. If you did, the cost was missing out on most of the year-to-date rally.

Wouldn’t it be better to have a process for adapting, in case the pundits are wrong?

We are delighted that we don’t have to depend on anyone’s opinion to be positioned well, in our view, for what lies ahead.

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead