Trend Following’s Response To Delayed Rate Cuts

May 31, 2024

Never mistake a clear view for a short distance.

—Paul Saffo

We believe a significant advantage of trend following is its ability to help investors manage emotions and behaviors by providing a clear, adaptable plan for any market scenario.

This systematic investing strategy aims to generate alpha through investment returns, but also to maintain discipline and consistency in the face of market fluctuations. In our view, trend following excels at managing market outliers — those rare, unpredictable events that can significantly impact performance. For example, NVIDA’s market cap has reached $2.6 trillion, $890 billion higher than all the companies in the S&P 500 Energy sector combined. Such unprecedented events underscore the need for a robust plan for navigating these exceptional occurrences.

Last month we discussed the tendency of markets to experience downturns and how trend following often takes a wait-and-see approach during small declines. Like we discussed could happen, April’s U.S. equity market declines were erased in May, as the market bounced back and set new all-time highs. This illustrates that trend following is less about predicting outcomes and more about maintaining a disciplined process. This investing approach enables decisive action without second-guessing, which we think is a significant advantage.

In this month’s Investment Update, we discuss our continued wait-and-see approach in fixed income, which has been significantly affected by what’s been happening — or not happening — with interest rates. Despite predictions of cuts in 2024, higher rates have persisted. Trend followers like Komara Capital Partners have navigated this uncertainty by adhering to our rules, which has allowed us to benefit from the high yields of short-duration instruments.

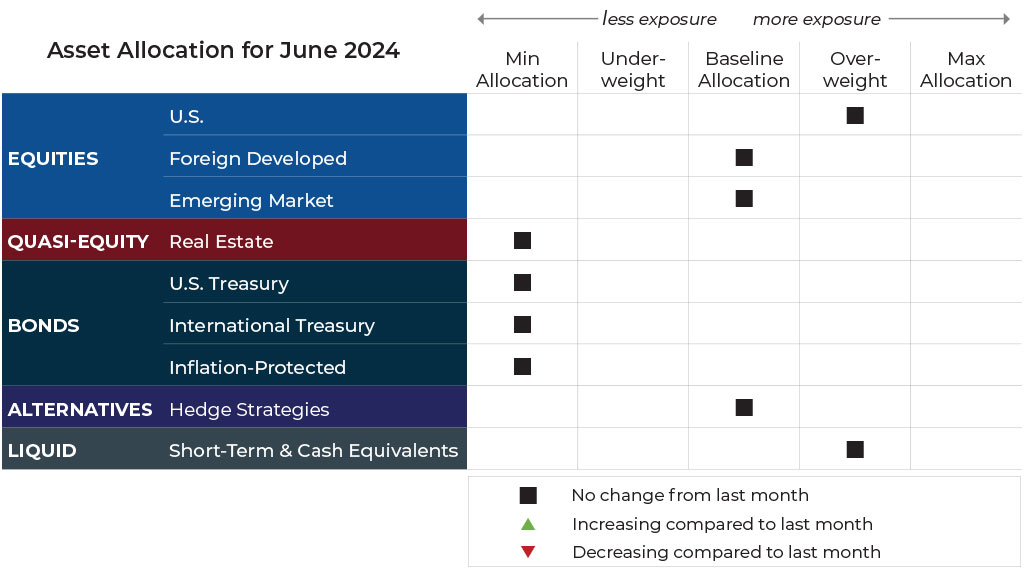

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for June.

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility

U.S. Equities

International Equities

Exposure will be at baseline allocation. Trends are positive across all timeframes.

Real Estate

U.S. & International Treasuries

Exposure will not change and will remain at minimum allocations as trends remain in negative territory.

Inflation-Protected Bonds

Exposure will not change and will remain at its minimum due to downtrends across both timeframes.

Alternatives

Exposure will be expressed through a multi-asset alternative ETF. The current allocation is long equities, long fixed income, slightly short commodities, and neutral to global currencies.

Short-Term Fixed Income

Exposure will not change as it continues to hold exposure from weaker fixed income instruments.

Asset-Level Overview

Equities & Real Estate

After breaking a run of five straight positive months by declining in April, the S&P 500 Index resumed its run by increasing in May, making new all-time highs in the process. While all segments again performed well, growth and tech remained the leaders. For the second consecutive year, the benchmark index will approach its halfway point with a double-digit return. As a result, our portfolios will remain overweight U.S. equities.

While still weaker over the long term compared to U.S. equities, foreign markets, including emerging markets, have managed to hold their own during the short term. Uptrends across all timeframes remain in place. Consequently, this segment will be at its baseline allocation as we move into June.

After looking like it could trigger an intermediate-term uptrend, real estate securities finished the month relatively poorly, causing downtrends to remain intact. Thus, allocations to this asset will remain at or near its minimum as we transition from May to June. This exposure will continue to be held within the much stronger U.S. equity asset class.

Fixed Income & Alternatives

Despite some economic reports supporting a case for interest rate cutting in 2024, fixed income instruments of any meaningful duration remain in downtrends across all timeframes and at their minimum in our portfolios. This result should not be a surprise for anyone who has been with us for any substantial amount of time. Allocations within the fixed income asset class will remain overweight to the very short end of the yield curve, and we remain completely out of longer-duration instruments.

For the portfolio’s alternatives bucket, the most notable changes will be an increase in net long equity exposure and a reduction in the net long fixed income segment. Only seven months ago, both were net short, which illustrates the ability of a multi-asset trend approach to adapt to changing conditions. Commodity exposure remains diverse, with notable longs in metals — such as gold and aluminum — and shorts in lumber and lead. Lastly, currency exposure is generally hedged, with meaningful shorts in the Swedish Krona, Brazilian Real, and Swiss France countered by longs in the Korean Won and Chinese Renminbi.

3 Potential Catalysts For Trend Changes

Chinese Economics: The new tariffs announced by President Joe Biden on roughly $18 billion worth of Chinese goods will not be economically significant relative to the GDP of China. However, the symbolism implied by the moves reinforces a shift in policy. By adding to tariffs imposed by former President Donald Trump, it signals that the decoupling of the Chinese and U.S. economies is becoming irreversible. Western countries have been trying to break China’s hold on raw materials that are essential for defense and green technologies. Those efforts have not produced many results: Chinese companies are becoming more dominant, not less. They are expanding operations, increasing supply, and decreasing the prices of metals like lithium, cobalt, and nickel. American and European challengers cannot compete.

Children are Expensive in America: New data about parents living with children under the age of 18 shows a decline in financial confidence. About 64% of parents said they were doing all right financially in 2023, down from 69% in 2022. Sentiment among that group has plunged since 2021 and is worse than Americans in general. About three-quarters of total respondents (all Americans, parents and not) said they were doing all right, down slightly from a year earlier. Perhaps the most jarring finding is that some households with young children reported paying nearly as much on child care as they did on housing.

World Needs more Children: The world is at a demographic milestone: The global fertility rate likely will soon drop below the point needed to keep the global population constant or increasing; or it may have already happened. The birthrate decline is across the board: in almost every region of the world, as well as for women across all levels of income, education, and labor-force participation. The decline has big implications for the way people live, how economies grow, and where the world’s superpowers stand. Since the pandemic, labor shortages have become widespread throughout developed countries. That is likely to worsen in coming years as the fall in birthrates results in an ever-decreasing flow of young workers, which also places strain on healthcare and retirement systems.

Rate Cuts: Still Waiting, Waiting, Waiting

If you fail to plan, you are planning to fail.

—Benjamin Franklin

We’ve reached a point of astonishment that more investors don’t rely exclusively on its techniques to run their practices. In our minds, the benefits are so self-evident that we occasionally find it surprising when someone needs extensive convincing.

To clarify, we love skepticism and questions. They give us a chance to provide the same “AHA!” we experienced many years ago. As an example, we have received plenty of questions (and some skepticism) about our positioning during Q2, which provides an excellent example of the merits of trend following, in our view.

In last month’s Investment Update we highlighted how markets tend to fall, like they did in April, but also how the discipline of trend following allows an investor to calmly stay the course — even when this can be emotionally difficult to do, given so many new all-time highs being set before April’s decline. Sure enough, we saw another resumption of the rally and more new all-time highs in May.

For us, it’s not about deciding what to do, it’s about committing to following our process and doing what it tells us to do when it tells us to do it. We didn’t have to think about what to do in May (or ever). All we had to do was act — or, as was the case in May, do nothing.

In our experience, most investors benefit from this kind of simplified approach to portfolio management. Simply, we think they have too many things to attend to in life to use anything more complex and time consuming.

Equities have illustrated the benefits of trend following during the last couple months, but the principles apply across asset classes, in our view.

On the fixed income front, few things are more impactful than the path and ultimate destination of interest rates. At the end of 2023 and beginning of 2024, investor sentiment had made a powerful shift from bullish on rates (bearish on bond prices) to the inverse: bearish on rates (bullish on bond prices). As we near the midway point of 2024, we see the consensus was once again incorrect.

At the start of the year, the bond market was pricing in 6-7 Fed rate cuts in 2024. Today: 1-2 rate cuts.

Has this shift hurt the stock market?

Not at all. The S&P 500 has already hit 23 all-time highs this year and is up 12% year-to-date (total return including dividends). pic.twitter.com/E25PT78aWP

— Charlie Bilello (@charliebilello) May 15, 2024

The expectation of multiple cuts by this point has been met with the reality of zero, zilch, none, nada. Fixed income or real estate investors betting on a drop in rates have not been rewarded, to put it mildly.

For us, as trend followers, this delay in rate cuts has not impacted how we allocate at all. We have simply stuck to our rules, which has generally kept us allocated to ultra-short duration instruments to take advantage of their relative strength and higher yields.

Moreover, the alpha generated as a result of staying long equities and low on duration in fixed income is not limited to numerical alpha. We believe it’s necessary for investors to manage their money in addition to their behavior and emotions. In our opinion, the best way to do that is to have a plan for whatever may transpire in the market and be able to communicate that plan simply. This may arguably be the most important benefit of trend following.

We are passionate about sharing our data and experiences to demonstrate the value of trend following. Please reach out anytime and know that there is no question too big or too small, in our view.

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead