Yesterday’s Home Runs Don’t Win the Game Today or Tomorrow

April 28, 2023

History never repeats itself. Man always.

—Voltaire

As a proponent of systematic investing, we often talk about the dangers of overfitting rules to past market behavior. This is a process known as “curve fitting.” We think it’s dangerous for many reasons, one of which is the notion that past market movements are not likely to repeat themselves in the future. As Mark Twain said, “history doesn’t repeat itself, but it often rhymes.”

In our view, human nature is the primary factor that leads to the future rhyming with the past. A person’s reaction to rising or falling market prices is about the only variable that can be consistently predicted. Fear, greed, envy, and a host of other emotions are embedded in our DNA and provide for very predictable behavior.

Unfortunately, and contrary to common belief, investment professionals are not immune to this behavior. This is why we employ a systematic investment process. WE are not immune to emotion – but the system we use is.

In this Investment Update we discuss the value of having a systematic investing process in the context of return chasing. Buying last year’s winners is an all-too-common thread in the investment world, as well as a behavior rooted in human nature. It is our belief that a better approach is to employ a set of simple rules that circumvent these potentially harmful behaviors.

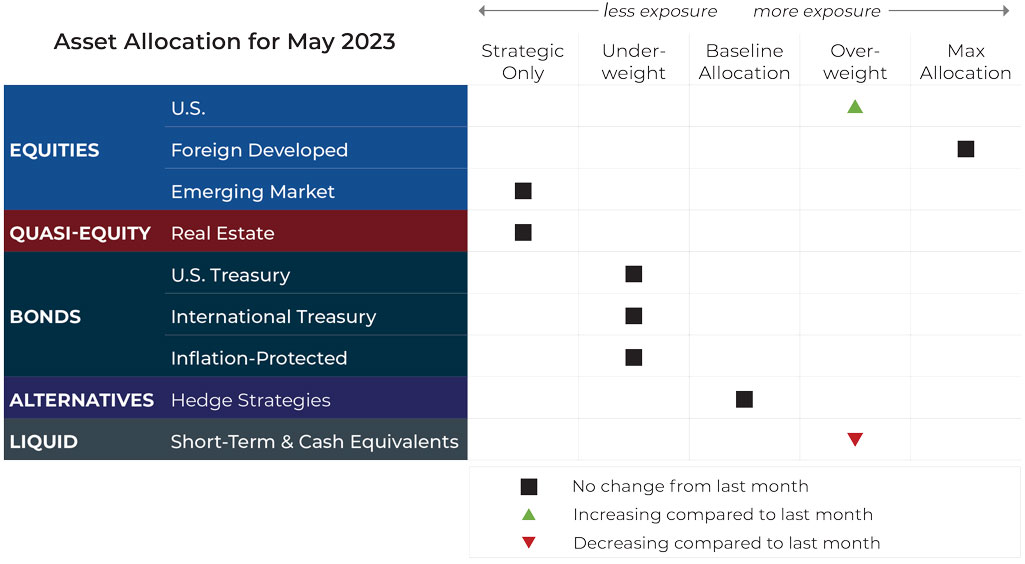

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for May.

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility

U.S. Equities

International Equities

Exposure will not change. Foreign developed equities continue to experience uptrends across both timeframes, while emerging market equities continue to have downtrends.

Real Estate

U.S. & International Treasuries

Exposure will be unchanged and remain underweight. Intermediate-term trends continue to be positive, while the long-term trends remain negative.

Inflation-Protected Bonds

Exposure will be unchanged and remain underweight. The intermediate-term trend is positive, while the long-term trend remains negative.

Alternatives

Exposure will not change. The baseline allocation for gold is also our highest limit, so we are already at the maximum allocation as the asset class continues to experience uptrends over both timeframes.

Short-Term Fixed Income

Exposure will decrease, as allocations are returned to strengthening U.S. equities.

Asset-Level Overview

Equities & Real Estate

After closing March with a three-day that caused the S&P 500 Index to climb 3.25%, April’s price activity was tame by comparison. The S&P is on pace to close slightly positive. In fact, the S&P 500 held a range within 100 points throughout April, which is a fraction of the distance it has traveled in the prior twelve months. To illustrate the point, the S&P 500’s range in April, as a percentage of the open, is the sixth lowest since 1993.

Parsing out U.S. equity markets:

- Dividend payers and value stocks were the leaders in April after lagging significantly in the first quarter. Even with the positive monthly performance, value and dividend stocks continue to hover near their 2022 close.

- Growth stocks, along with small and mid caps, are on pace to finish negative for April. For growth, this is merely a dent in what has been a bit of a recovery year after 2022’s disastrous performance, but mid and small caps continue to perform more in line with value and dividend stocks.

To sum things up for U.S. equities, higher lows in prices and low volatility has resulted in uptrends for the broader market, which means our portfolios will increase exposure. Portfolios will actually go overweight, as this asset class picks up exposure from weaker real estate securities.

Foreign developed equities are on pace to once again lead global equity markets for the month in positive territory. Our portfolios have been overweight since January in response to this strength and will continue to be in May. On the flip side, emerging markets have reverted back into downtrend status after briefly hitting an intermediate-term uptrend. Our portfolios remain at their minimum allocation as a result.

Real estate securities continue to experience downtrends across both timeframes. As a result, all our portfolios remain at their minimum allocation. As mentioned above, this exposure has been handed off to stronger U.S. equities.

Fixed Income & Alternatives

Very little has changed in the world of fixed income since our last update. The middle of the yield curve continues to be strongest from a price perspective, with bonds in duration from three years to 20 years posting intermediate-term uptrends. Treasuries in duration from one year to three years, as well as those above 20 years, continue to experience downtrends across all timeframes. Exposure in our portfolios is underweight, reflective of the weakness, and will not change in May.

Gold’s price moved very little in April but remains in uptrends. It has been one of the leading asset classes for 2023 and thus will continue to be at its maximum exposure in our portfolios.

3 Potential Catalysts For Trend Changes

GDP Report: U.S. economic growth decelerated to a 1.1% annual rate in the first quarter. It marks the second declining quarter in a row, as inflation- and seasonally adjusted growth was 2.6% in the fourth quarter of 2022 and 3.2% in the third quarter. Projections from The Wall Street Journal for the remainder of the year are flat to slightly negative.

Home Prices: The latest data shows that home prices rose in February from the prior month, breaking a seven-month streak, as buyers began to compete again for homes for sale. Additionally, after rising to 20-year highs last fall, mortgage rates declined in December and earlier this year, which brought home buyers back into the market. The number of homes for sale also remained unusually low, keeping the buyers’ market competitive in parts of the country.

Declining Confidence: The April report from The Conference Board showed consumer confidence declined in March, Americans’ assessment of current business and labor market conditions improved, and consumers’ expectations for the coming months dropped. Considered together, the measures signal a looming recession.

Why ‘Keep It Simple’ Resonates Deeply

Yesterday’s home runs don’t win today’s games.

—Babe Ruth

In our update last month we outlined both a bull case and bear case for what lies ahead in the markets.

The point of doing so was to illustrate the folly in making investment decisions based on predicting market behavior. As our clients know well by now, we are instead avid supporters of designing and implementing systematic investing processes for adapting portfolios in a predetermined way. We think this gives clients the best chance of meeting their goals over 10, 20, 30, or 50 year windows, regardless of what transpires in their lives (and the markets).

The markets never perfectly repeat past behavior. However, our research indicates to us that there’s enough of a pattern that a rules-based, systematic framework can help with navigation.

Markets generally fall into one of these periods of trend:

- Up

- Down

- Sideways

Different rules applied within these periods will result in different performance profiles in terms of return, volatility, and correlation in comparison to a benchmark, such as the S&P 500. One set of rules is not necessarily better than another, and any form of repeatable trend following is better than none, in our opinion.

The systematic investing rules used in our portfolios aim to capture as much upside as possible. We apply the investing process to a broadly diversified portfolio, and we take into consideration tax consequences and downside risk.

A systematic investing process with predetermined rules for each of the previously-mentioned trend environments will usually do part of the work that’s needed to help manage emotions during turbulent times. But we – this includes you, as well as me, as your advisor – aren’t immune to reacting to market conditions with feelings of fear, greed, envy, and a host of other emotions because it is embedded in all of our DNA.

We see how these predictable human emotions and behaviors are at play throughout the industry. It is almost comical how even financial professionals will fixate on previous performance, constantly chasing the recently best-performing asset rather than sticking with a tried-and-true process.

The last three years are a prime example:

- Growth and tech: Our strategies have been challenged at various times by the latest hot asset class. A recent example is how growth and tech-oriented factors were top-performers at the end of 2021 (their last peak), only to become among the worst performers in 2022.

- Commodities: We have also seen firms eschew commodities for years, only to buy them at their peak in 2022.

- Crypto: And don’t even get us started on crypto assets. It was almost an everyday occurrence in 2021 for someone to ask us about adding crypto to our portfolios or how they could benefit from it. Now, when it is arguably a better investment since almost NO ONE is talking about it.

These examples remind us why the acronym KISS (Keep It Simple, Stupid) resonates deeply. Years of working with market data yield a few universal truths, as we see them:

- Almost all of a given market’s return is produced when it is in an uptrend (we know this sounds obvious, but it conflicts with commonly held sacred cows like the best 10 days rule)

- Bad things tend to happen when you hold a market that is in an extended downtrend – note we didn’t say “any downtrend,” we said “extended downtrend” because not all declines are created equal

These ideas and the underlying rules that support them are why we:

- Will continue to increase large cap U.S. equity exposure for May

- Are keeping high exposure in foreign developed equities, but low allocations in emerging markets and real estate

- Have had almost no exposure to long-duration fixed income for almost two years, but have kept high exposure to relatively ultra-short duration assets

- Are at maximum allocation for gold recently

What we’re building and executing is not flashy. It will not receive high praise in the mainstream. We will probably not be asked to join a speaking circuit. We’re OK with all of that because our goal is to provide a foundation for serving clients, as well as the type of white glove service that almost NO ONE else is providing.

We can’t guarantee performance but we can vow to follow our systematic investing process with discipline and to provide service marked by its intensity and responsiveness.

Our mantra remains: Control what you can, and seek to maximize the reward per risk on what you can’t.

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead