Having Rules Means Never Having to Guess What to Do Next

September 29, 2023

A masterly retreat is in itself a victory.

—Norman Vincent Peale

At Komara Capital Partners, we think a lot about survival. If you spend a few days with our team, you’ll hear phrases like, “Survive and advance,” or, “Live to play another day.” These aren’t indicative of a pessimistic outlook; quite the opposite. They stem from our commitment to rationality and objectivity, particularly concerning risk.

As trend followers, we accept defined, measured losses as part of our investing strategy. This isn’t about ego or trying to predict the unpredictable. We don’t fight the market or burden ourselves with endless what-if scenarios. Instead, we focus on repeatable, consistent execution.

In our view, trend following is as a strategy that’s rooted in survivability. While we might endure more frequent minor losses, we think this approach helps us avoid catastrophic ones. It’s about staying in the game today so we can seize tomorrow’s opportunities.

In this Monthly Note, we discuss our plan for reducing equity risk heading into October, and we explore one of the benefits of a systematic investment process: having an adaptable plan, even as markets continue to evolve. Having rules means never having to guess what to do next. And yet, that doesn’t make following them easy.

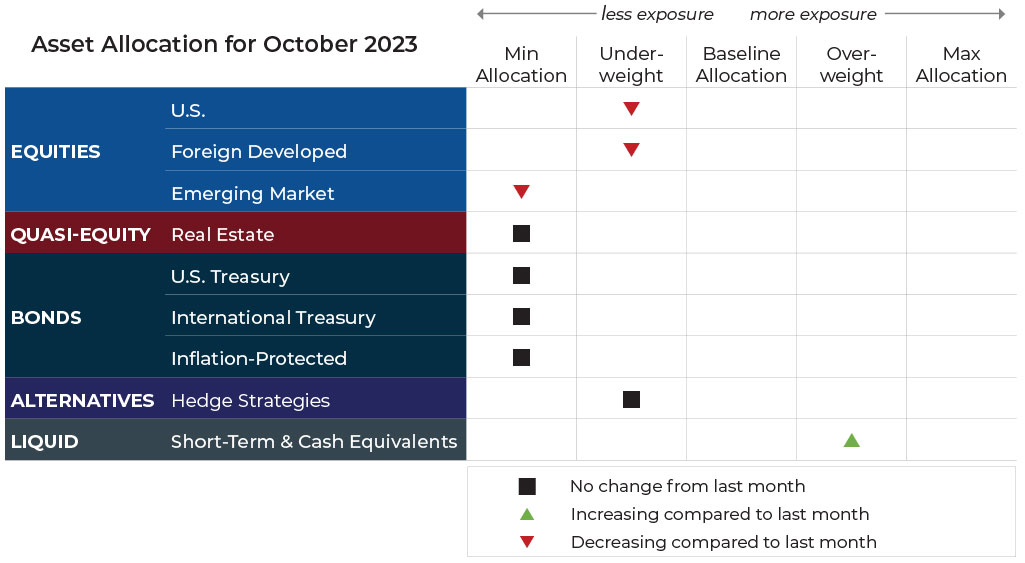

But first, here’s a summary of the global asset classes utilized in our portfolios and their exposures for October.

Asset Allocation Update

Source: Blueprint Investment Partners

Adjustments can vary across strategies depending on each strategy's objectives. What's illustrated above most closely reflects allocation adjustments for the Growth Strategy. Diversification does not guarantee investment returns and does not eliminate the risk of loss. Diversification among investment options and asset classes may help to reduce overall volatility

U.S. Equities

International Equities

Exposure will decrease and remain underweight. Both foreign developed and emerging market equities continue to experience intermediate-term downtrends. For emerging markets, the long-term trend is now also negative.

Real Estate

U.S. & International Treasuries

Exposure will not change and is at its minimum allocation due to downtrends across both timeframes.

Inflation-Protected Bonds

Exposure will not change and is at its minimum allocation due to persistent downtrends across both timeframes.

Alternatives

Exposure will not change, as gold continues to couple an intermediate-term downtrend with a long-term uptrend.

Short-Term Fixed Income

Exposure will increase, as it receives allocations from weaker assets across the spectrum.

Asset-Level Overview

Equities & Real Estate

Similar to the story in August, major equity indexes declined in September, with tech and growth among the worst performing. As we enter the final quarter of 2023, the majority of equity indexes cling to positive year-to-date returns; value- and dividend-oriented in negative territory; and only growth, tech, and large-cap indexes sit comfortably with positive annual gains.

The now two-month-old retracement has brought many segments of U.S. equities into an intermediate-term downtrend. Although long-term trends generally remain positive for now, the change in intermediate-term trends will result in reductions in exposure across our portfolios.

International equities have fared slightly better over the last 60 days, but have also declined. Because they have declined from a weaker initial position relative to their U.S. counterparts, international equities have more quickly succumbed to downtrends. Emerging markets have returned to downtrends across both timeframes, a space the asset class has occupied frequently since the end of 2021. Foreign developed maintains a long-term uptrend for now, so its exposure will not decline as severely.

Real estate securities now sit near their 2022 and one-year lows, which is perhaps remarkable given how well some equity segments have performed in 2023. However, inflation and interest rate narratives have punished this asset class. Accordingly, our portfolios will maintain their minimum exposure levels.

Fixed Income & Alternatives

The same mechanism that has sustained pressure on real estate is at work in fixed income as well. For assets of any duration, trends remain negative and our allocations remain small. The beneficiary from an exposure perspective continues to be ultra-short-term fixed income instruments, which will not only stay high in our portfolios but increase due to taking on exposure from weaker equity assets.

Gold exposure will be steady. The intermediate-term trend continues to sit in negative territory. The long-term trend remains positive.

3 Potential Catalysts For Trend Changes

The Shutdown: U.S. House Speaker Kevin McCarthy rejected a bipartisan short-term funding bill from the Senate in favor of a House Republican plan driven by conservatives. The action decreased chances of deal and raised the likelihood of a partial government shutdown starting this weekend. Lawmakers now anticipate that Congress will fail to fund the government past September 30, a lapse that will partially close federal agencies and temporarily withhold pay for federal workers and active-duty military personnel.

Consequences: Federal Reserve officials are carefully trying to slow inflation without creating an economic meltdown. It’s a difficult task that could be made even more challenging if there is an extended government shutdown. If Congress does not pass a stopgap funding measure before Sunday, a shutdown could delay the routine release of economic data about wages, employment, inflation, and output.

Slowdowns and Lawsuits: The race to hire warehouse workers and package carriers for the holidays is slowing to a crawl compared to last year. Logistics companies and fulfillment specialists generally are keeping their hiring flat this year, as concerns about consumer spending continue. Additionally, the Federal Trade Commission and 17 states sued Amazon, alleging the company illegally wields monopoly power that keeps prices artificially high, locks sellers into its platform, and harms its rivals.

Having A Plan Is Excellent, But It is No Panacea

Everyone has a plan until they get punched in the mouth.

—Mike Tyson

A frequently noted benefit of trend following process is that it comes with a plan for how to react when markets are constantly evolving. Having rules means never having to guess what to do next. And yet, that doesn’t always make following them or accepting the result palatable.

Having a plan is excellent, but it is no panacea.

We often say that the plan and the rules behind the plan are not as important as the conviction and discipline to execute. No matter how sophisticated one’s rules or algorithms are, the market has a way of testing them. September was a good example.

In the Investment Update from last month, we spent some time revisiting our risk handoff strategy and noting how trends in international equities were causing an allocation migration to U.S. equities. Many times we are rewarded for following our risk handoff strategy and systematically moving along a chain of similar assets in search of stronger, positively-trending markets that may offer greater return potential than fixed income or cash. However, as the last 30 days of U.S. equity performance shows, it’s not always the case. This is why trend following, at times, can be difficult.

However, as trend followers, we accept defined, measured losses as part of our investing strategy for several reasons. One is because we know that a nuance of quantitative systems is that once you venture from the design, you run the risk of large variations from the desired outcome. One may assume that small deviations on execution would lead to only small deviations on outcome, but a small compromise has a way of snowballing into many more. Before you know it, you risk going from having a complete system to having no system at all.

For October, we are not deviating from our system and therefore are reducing exposure to U.S. equities, the one asset class that has done well in 2023. That decision doesn’t come easy, but it’s part of the process.

Fortunately, our portfolios are hedged well either way for October due to Treasury bill rates being at their highest levels since January 2001 and our equity exposure being high enough to benefit if there’s a reversal upward. If equity markets continue to decline, our expectation is the portfolios should outperform. Likewise, if equities rally, we should benefit and be able to quickly add back exposure heading into the final months of 2023.

Our plan, patience, and discipline is always being tested, but our confidence remains steadfast.

Let's Talk

If you have any questions about what transpired in the markets last month or portfolio positioning for the month ahead