5 Common Money Management Mistakes And How to Avoid Them

December 14, 2023

The financial markets are complex. Investments vary greatly and respond differently in various market conditions. What works well in one economy may not work well in another. One investment mistake could have a significant impact on whether you reach your financial goals.

Raising your level of awareness of these potential pitfalls is the first step in avoiding them.

The following are principles and systems that can help mitigate your risk.

1. Not having a braking system in place when your investments decline

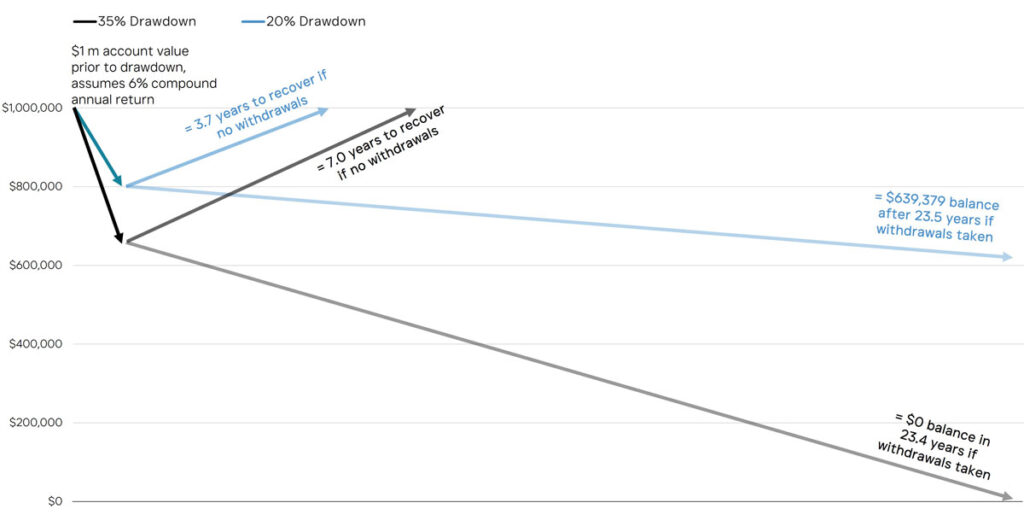

In the beginning, when losses are small, the amount needed to recover is almost one to one. But as losses increase, the amount needed to recover increases dramatically. The graph below illustrates this concept.

Impact of Drawdowns on Compounding Potential

Suppose you have an account valued at $1 million and you experience a 35% decline, which isn’t too different from the S&P 500’s decline in 2008. Now your $1 million account is valued at $650,000.

What do you think you need to earn to get back up to $1 million? It is not 35%, like many people think. It’s more like 50%. And how many years is it going to take you to accumulate those gains to get back to even?

If you’re near or in retirement, it’s even more important to minimize catastrophic losses like this becomes they could have a significant effect on the amount of income you’re able to draw from your investments and how long your nest egg will last.

Having a braking system in place can help minimize the effect of market declines on your investments.

Remedy

The price of a security or asset class is the primary thing that makes your account go up, and it’s the primary thing that makes your account go down. This fact is why Komara Capital Partners makes price an integral component when managing your investment portfolio.

We believe financial markets give us directional data. In other words, is a particular security or asset class trending up, down, or unchanged based on its price over certain periods of time?

We turn that data into action by using an exponential moving average formula to track trends on 10-, 50, 100-, and 200-day timeframes. When a downward trend occurs, our investing system automatically begins to decrease exposure to that security or asset class. We believe that, over time, this approach helps you win more by losing less.

Conversely, if an upward trend develops, we begin increasing exposure in that area.

Our investing systems seek to keep losses contained or minimized, while allowing well-performing securities or asset classes to continue advancing within your portfolio.

2. Moving immediately to cash when markets get volatile

When the markets decline, it may seem prudent to sell and “park” all of your investment money in some form of a cash equivalent (e.g., a money market fund, short-term Treasuries, or short-term certificates of deposits). However, doing this may disrupt the positive effects of compounding.

In a normal interest rate environment, parking your investment dollars in cash typically results in a low yield. And if those assets are in a taxable account, that lower yield may turn into a net negative after-tax return.

Just because a particular security or asset class is in decline, that does not necessarily mean all asset classes are in decline. There may still be asset classes in an uptrend that you can take advantage of.

Famed investor Charlie Munger said it this way: “The first rule of compounding is to never interrupt it unnecessarily.” It may be possible to reduce your risk (sell), maintain compounding, and avoid going completely risk off (going completely to cash).

Remedy

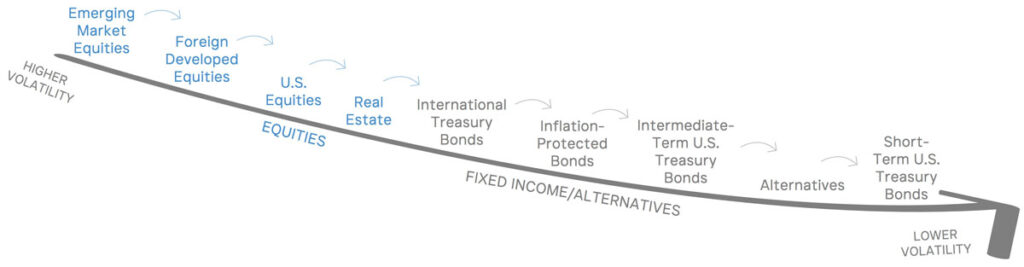

Assets can be ranked from more aggressive (i.e., higher volatility with potential of higher growth) to more conservative (i.e., lower volatility with potential of moderate growth). For example, emerging market equities are typically more volatile than foreign developed equities, which are typically more volatile than U.S. equities, which are typically more volatile than real estate, which is typically more volatile than international Treasury bonds, and so on.

At Komara Capital Partners, when a downtrend emerges in any given asset class, we “handoff” that exposure to the next, less volatile asset class experiencing uptrends. If none of the asset classes are in uptrends, we will eventually go all the way down to U.S. Treasuries. This gradual handoff process allows us to reduce risk without going completely “risk off.”

Risk Handoff Strategy

When an uptrend re-emerges, we do the opposite and “handup” exposure by taking from asset classes experiencing downtrends or, if several asset classes are in uptrends, by shifting exposures back to baseline weightings.

3. Allowing your emotions to dictate your buy and sell decisions rather than using a repeatable decision-making system

As human beings, we are prone to recency bias. Simply put, if we experience something positive or good, we expect similar results going forward. Conversely, if we experience something negative or bad, we think that trend is going to continue.

In the world of investing, if the financial markets have been in an uptrend, we tend to think they’re going to continue in that direction, and we make investment decisions based on that. And if the market has

been in a downtrend, we tend to think it is going to continue in that direction, and we make investment decisions based on that.

One of the conclusions of behavioral finance research is that investors are influenced by their psychological biases. These biases may result in suboptimal investment decisions, such as buying high (i.e., paying a premium for a security) and selling low (i.e., selling at a loss).

Research shows that as individual investors overreact and underreact to news and information, these behaviors can impact their financial well-being. In fact, during the 30-year period that ended December 31, 2022, the stock market averaged a 9.65% annual gain, but the average stock fund investor averaged only 6.81% per year. That 2.84% difference may not seem like much at first – but multiply that over the years and you’re looking at a big number.

Remedy

The question is: How do you optimize for better investor behavior?

At Komara Capital Partners, we believe the answer is this: Remove emotions from the decision-making process.

Systematic investing is a tool for removing emotions, predictions, and gut feelings from the investing equation. They get replaced by repeatable rules that answer questions about what, when, and how much to buy and sell.

A reliable systematic investing process can provide a more tangible sense of security because even if you don’t know WHAT will happen, you know HOW your process will adapt.

Using a repeatable investing system also means you don’t have to put pressure on yourself to know what the market will do next. In fact, we believe even the so-called experts are clueless about what the market will do next; it’s why we don’t recommend making investment decisions based on their forecasts or predictions. The criteria these experts used to generate their predictions could all change the very next day, week, or month – which could modify their predictions substantially.

Having a rules-based investing system in place can help remove some of the uncertainty about the markets and smooth out your investment ride, helping you sleep better at night.

4. Focusing on investments rather than strategy

Investors utilize a variety of methods to decide which securities they are going to hold in their portfolios, such as:

- Risk tolerance questionnaire scores, which help determine the mix of equities, fixed income, alternative, and other investments

- Monte Carlo simulations, which are designed to randomize growth rates over multiple trials to demonstrate a range of results and the likelihood of success for an investor’s goals

- The efficient frontier, which is a set of portfolios believed to be optimal for offering the highest expected return for a defined level of risk and can be a guide for investors to determine if their investment selections fall within an acceptable range

- The standard deviation of a security or several securities, which measures how dispersed an investment’s return is in relation to the mean – low deviation means an investment’s return data is clustered near the mean and is indicative of lower volatility, while high deviation means an investment’s return data is more spread out and indicative of higher volatility

- The Myers-Briggs Type Indicator and other behavioral tools that describe the range of emotions an investor will likely feel as they use investment models with varying degrees of volatility, which help determine if the investor would be comfortable with a particular type of asset allocation

All of these instruments can be useful in designing an appropriate portfolio. However, we think there is a specific and ideal way to begin the process.

Remedy

Famed leadership and business consultant Stephen Covey stated, “Begin with the end in mind.” This means beginning with a clear vision of your desired direction and destination. It is based on the principle that all things are created twice: there’s the mental creation, and then there’s the physical creation. The physical creation follows the mental, just as a building follows a blueprint.

We believe the most effective way to design an investment portfolio is to begin by helping an investor define what a truly wealthy life looks like for them. How? By having a Financial Blueprint Conversation to discover your values and vision for life.

From there we take inventory of all the relevant financial facts that can impact the quality of your financial future. We use that data to design a comprehensive financial plan that includes your “Family Index,” which is the rate of return you need to average to achieve your goals and experience the life you envision. Determining that rate of return greatly helps the decision-making process about which investments are appropriate or inappropriate to buy and sell.

At Komara Capital Partners, we believe a comprehensive financial plan should also include an Investment Policy Statement, which defines your specific objectives, benchmarks, risk tolerance, asset allocation guidelines, any security or sector-related restrictions or requirements (e.g., quality of investments, tax considerations, liquidity level, income, and distributions), and which strategies to utilize.

5. Not managing your investment gains for tax efficiency

Certain investment accounts have built-in tax benefits, whether tax-deferred or tax-exempt retirement accounts. But these accounts are not usually flexible due to rules about withdrawals and limits on contributions.

That’s where taxable accounts can provide versatility. You can add or take money out with few limits, penalties, or restrictions. There are also no required distributions. Additionally, there generally are no trading restrictions or limits on investment options.

While your gains may be taxable in a taxable account, investors can minimize their taxes by carefully selecting the investments they buy and sell, as well as by using tax-smart strategies.

Investors who do not use tax-reducing strategies may expose their short-term gains (i.e., investments held for less than 12 months) to short-term capital gains tax. These gains are taxed at the investor’s federal income tax rate, which ranges from 10-37% depending on your taxable income. On the other hand, investments exposed to long-term capital gains tax (i.e., those held for more than 12 months) receive long-term capital gains tax treatment, which ranges from 0-20% depending on your taxable income.

Utilizing tax-smart strategies can help you keep more of your capital gains.

Remedy

Here are several strategies that have the potential to minimize your tax bill and increase after-tax returns in a taxable account, in no particular order:

- Prioritize long-term capital gains: When it is prudent to do so, hold investment assets for 12 months or longer in order to qualify for the usually-lower capital gains tax rates rather than the usually-higher ordinary income tax rates.

- Apply tax-loss harvesting: Not every investment is a winner. We suggest using an investing system that can sell investments that are at a loss when it’s appropriate to do so. Those capital losses can offset your capital gains on a dollar-for-dollar basis. You can then use the capital from your sale of those assets to reinvest the money in a different security that meets your needs. If your capital losses exceed your capital gains, you may be able to offset up to $3,000 of your ordinary income.

- Earn qualified dividends: Ordinary dividends (e.g., from passive funds) are paid out of earnings and profits and treated as ordinary income that’s taxed at ordinary income tax rates. Qualified dividends must adhere to a minimum holding period and are taxed at the capital gains tax rate.

- Use tax-efficient bonds: Tax efficiency is not limited to stocks. Municipal bonds – which are bonds issued by state, local, and county governments – are exempt from federal taxes. If bought within your state of residence, they may also be exempt from state and local taxes.

- Consider a charitable trust: Even if your charitable donations are altruistic, making them through a charitable trust can offer tax benefits in two ways: the amount of your taxable income is usually reduced for income tax purposes, and you remove assets from your taxable estate. By choosing to donate appreciated securities to a charity, investors may be able to avoid paying capital gains tax, while also receiving a tax deduction for the donation.

At Komara Capital Partners, we work with clients to determine which of these strategies – and sometimes we use more than one of them – are best suited to help you achieve your financial goals.

Sourcing: Forbes.com, “Should Investors Move To Cash Right Now?” 4/25/2023

Let's Talk

To discuss how we can partner to create your blueprint for a truly wealth life